The new age T&M equipment needs to identify, isolate and analyze.

29 Jan 2023

Accurate testing and measurement is critical in electronic systems design and manufacturing to ensure product quality. Test and measurement (T&M) systems play an essential role in ratifying the performance of a wide range of electronic products. Increased product complexity has spurred the demand for precision testing at every stage of the product’s life cycle, right from design and development to production testing, pre- and post-market testing, as well as support. Thus, the growth of the test and measurement industry goes hand in hand with the growth of the electronics industry in the country. To find out more about the latest developments in the T&M space, the ComConnect Consulting team did some market research.

The budget is keenly followed not just for the immediate fiscal measures but also for the policy priorities of the government. At the crossroads, where the overall economy and the power sector stands, the pronouncements of the budget will be keenly followed. In the current fiscal, overall economic growth has dipped sharply and, in all likelihood, GDP growth will be under 5 per cent. This has been one of the key contributing factors for the stagnation of power demand. Simultaneously, the supply pipeline has been quite full, resulting in falling load factors of thermal power plant s and curtailment of renewable energy. Given the ambitious plans of the government to double the renewable energy capacity to 175 GW by 2022 from 86 GW at present, all investors will be nervously watching for moves that will perk up the economy and, consequently, electricity demand.

Even as capacity in the power sector has expanded significantly in the past decade, this has heavily depended on equipment imports, particularly from China. As a consequence, more than 200 GW capacities has been added in the past decade at an estimated cost of 10 lakh crore but without creating commensurate jobs and competencies. At this moment, the unemployment rates stand at a 45-year high. The government would be concerned about this and hence, I do expect the policies and fiscal measures to be focused much more on domestic job creation. The fiscal incentives could thus be towards encouraging domestic production and making the investments viable and prices competitive vis-à-vis imports of equipment such as solar power, including panels, inverters, transmission equipment and other principal components.

The competitiveness of the economy also depends on the efficiency of operations in the power sector and electricity prices. The tariffs of industrial and commercial electricity are abnormally high in India rendering energy-intensive manufacturing uncompetitive. While the budget is not the platform for tariff rationalisation, there could be some reduction in duties to reduce consumer tariff, particularly in the industrial sectors. Recent news reports indicate that elimination of the coal cess of INR400 per ton of coal has caused the cost of coal-based power generation to increase significantly with an impact of more than 50 ps/kwh. Given that the coal cess has been used primarily for GST compensation to states in recent years and there is little revenue buoyancy at this time, I would be pleasantly surprised if the cess is done away with. A reduction, however, is more likely on the cards.

Finances of state-owned power distribution companies have been in the cesspool for decades. The UDAY scheme marked a serious effort to set this straight. Despite the initial promise, UDAY has not delivered the outcomes that the government desired. A new programme marking a renewed effort is on the cards. It needs to be seen how this is different from past initiatives and how it would deliver better than past attempts. The bottom line, however, is that no amount of budgetary support and over-the-top interventions can mend the sector’s finances unless very fundamental changes are made to the way the sector is structured, operated and regulated.

The core structural challenges in the distribution sector have to be dealt with through the introduction of competition and transparency. Directional messages on opening up the sector to competition should be sent through the budget. In line with the current economic thinking of the government on increasing private sector participation, it would be worth providing incentives for franchising and privatisation for accelerated technology deployment for improving customer service and reducing losses. This could be on capex up to a certain limit per lakh of customer base. It is important to incentivise R&D in renewables and storage technologies with an aim to create patented technologies for those that are aligned with India’s needs. R&D in this space, including associated manufacturing and installations, is a good avenue for tax breaks.

All of this though must lead to kick-starting demand and we need the right set of incentives for efficient consumption. This, in turn, would reignite the investment cycle and, eventually, lead to a higher energy/electricity off take. Hence, while the budget would always contain a range of direct measures affecting the electricity sector, the greatest emphasis has to be on scaling up manufacturing, creating new jobs in a sustainable manner and removing distortions that have prevented India from emerging as a strong manufacturing economy. Those measures would be of much greater importance than some individual steps to prop up the power sector specifically.

By the ComConnect Consulting research team

Accurate testing and measurement is critical in electronic systems design and manufacturing to ensure product quality. Test and measurement (T&M) systems play an essential role in ratifying the performance of a wide range of electronic products. Increased product complexity has spurred the demand for precision testing at every stage of the product’s life cycle, right from design and development to production testing, pre- and post-market testing, as well as support. Thus, the growth of the test and measurement industry goes hand in hand with the growth of the electronics industry in the country. To find out more about the latest developments in the T&M space, the ComConnect Consulting team did some market research.

Market opportunities

India has the potential to be among the forerunners in the next phase of technology innovations. The Indian electronic systems design and manufacturing (ESDM) sector has witnessed steady growth in recent years, with the focus shifting from pure play system or product design to include other areas such as product development, original design manufacturing (ODM), etc. Therefore, immense business opportunities are brewing in the Indian T&M industry.

Performance of an electromechanical system is determined by the performance of individual power electronic components and switching devices. Hence, there is a need for accurate measurement of responses of power electronics, and other electrical and physical parameters. This article describes the different types of measurement equipment required for power electronic systems.

To select a measuring instrument for testing these systems, it is necessary to understand the testing parameters at various development stages. Test and measurement (T&M) equipment enable predictive and preventive inspections to minimise the risk of defects, accidents or electronic systems breakdowns. You can also derive optimum efficiency and operation for all kinds of troubleshooting.

High growth in the Indian T&M equipment market is due to technology developments, expanding end user applications and the growing need to validate the performance of equipment. Other factors driving growth in the T&M domain are the stringent quality, safety and environmental standards for manufacturing, maintenance and the use of equipment. Moreover, proper implementation of government initiatives like Make in India, 100 Smart Cities, Digital India and the defence manufacturing drive will definitely open up new opportunities for T&M industry players.

According to the industry experts who participated in the survey, the current Indian T&M market (that’s linked to the ESDM industry) has an approximate turnover of US$ 150-200 million. However, the market presents a much bigger opportunity considering that Frost & Sullivan, a market research firm, forecasts that the Indian market for general-purpose electronic T&M instruments will touch US$ 300 million by 2022.

Market drivers

The Indian T&M market is driven by both global and domestic demand. Growth in this market is a result of the growth registered by the key end user segments like automotive, aerospace and defence, electronics design, etc. Defence and other government sectors have also been instrumental in driving the growth of this sector. Our experts forecast automotive followed by telecommunications, aerospace and defence as well as electronics design as the major demand generating application sectors.

The trend of automotive companies switching to automated testing is driving up demand for T&M equipment. The increasing electronic content in vehicles—for infotainment, connectivity and safety purposes, along with the growing acceptance of green mobility (through e-vehicles) will also fuel the growth of the T&M sector. Besides, the increase in R&D activities across the electronics industry value chain is expected to drive up demand. The experts also highlighted the bright future of the defence manufacturing ecosystem in India and the related opportunities for the T&M segment.

India has vast potential in telecommunications and mobile manufacturing too. With the ‘Make in India’ initiative creating a wave of opportunities, mobile manufacturing is all set to gain further momentum. Therefore, experts are also looking forward to the burgeoning opportunities in mobile handset manufacturing and allied verticals like mobile services, cable TV, broadcasting, etc. Smart cities are also likely to boost the power and communications sectors in India and eventually contribute to the growth of the T&M industry.

The demand for electricity across India has been growing at a rapid rate and is expected to increase further in the years to come. To address this, power generation, transmission and distribution companies will have to invest in reliable, accurate and efficient equipment to protect their assets from failure. Therefore, the growth prospects of T&M equipment related to the industrial electronics sector are quite promising. India is an emerging solar hub of the world, considering that capacity for nearly 100GW of solar power is to be added in the next five years. So solar power could become a very important market for T&M products.

Emerging trends

The need for a connected and safer world, leveraging advances in the Internet of Things (IoT), machine-to-machine (M2M) interaction, autonomous driving and 5G are the new technology trends that will lead to the growth of the T&M industry worldwide and in India too.

According to the latest study by Frost & Sullivan, titled, ‘Global Electronic Test and Measurement, Forecast to 2022’, the growth will span a range of technologies and cover the entire product life cycle—from R&D to manufacturing and quality assurance.

In the next five to ten years, a lot is expected to happen, whether in the wireless technology or application areas. For example, IoT is one of the key driving factors. The proliferation of smart devices has begun to influence the design and use of T&M equipment. Each ‘smart’ product has to go through a specific set of processes to ensure its usability and functionality for the intended purpose – and behind each of these steps are the design, manufacturing and testing procedures. T&M technologies are going to evolve accordingly. There are emerging needs for embedded/portable T&M solutions, IoT test solutions with remote troubleshooting capabilities, and solutions that can support the latest interfaces and protocols.

In wireless technology, the emergence of 5G is going to change the technology landscape. The greater need for interoperability and 5G are the top two emerging trends in the global T&M market. Two key features in 5G NR are especially important for the realisation of higher data rates than in LTE—the use of millimeter wave frequencies (up to 100 GHz) and support for significantly higher signal bandwidths. In particular, 5G NR supports signal bandwidths up to 100MHz for carrier frequencies below 6GHz and up to 400MHz for frequencies in the millimeter wave range.

These developments present new challenges for development engineers. Designing power amplifiers that exhibit the necessary characteristics (e.g., linearity) is not easy and may need new design approaches (e.g., digital predistortion). The circuitry needed to generate frequencies in the millimeter wave range requires well-thought out design and the careful selection of components in order to reduce the effects of phase noise introduced by mixers and multipliers. Beamforming also requires very good amplitude and phase synchronisation between antenna elements in active antenna systems.

The high frequencies intensify the challenges for T&M methods. The short wavelengths and higher losses in circuits necessitate tight integration, making it impractical to supply connector ports for testing. At the same time, the effects of connectors and test fixtures become non-negligible, potentially affecting the validity of the measurements recorded. As a result, over-the-air (OTA) testing will play an important role.

Automation powered by M2M interaction is the new technology trend in the power sector and, hence, the demand for automated products is growing. Accordingly, the new technological advancements like data logging DMMs and automated power-calculating power clamp meters will experience good growth. Online transmission line monitoring systems, compact tan-delta testing machines, automatic breaker testing machines, discrete monitoring of power losses at each feeder by distribution companies, etc, are some of the key areas of application.

With respect to the user experience, touchscreen technologies are going to revolutionise the T&M environment. A combination of the right hardware with a ‘designed for touch’ user interface (UI) will enable companies to use equipment easily and efficiently. ‘Designed for touch’ UIs are crucial for creating an effective and usable touchscreen, since it is not enough to simply add a touchscreen to an existing UI. The new age T&M equipment needs to identify, isolate and analyse a system under test as quickly and efficiently as possible. Having an effective touchscreen on the instrument can reduce the time it takes to configure the system and to analyse signals. Thus, instruments with better GUIs result in ease of operation and automated testing capabilities, which increases productivity.

Faster switching power electronic devices

The trend in power electronics is to push the operating frequencies higher to reduce size, weight and cost of the systems. This requires faster switching power electronic devices, such as SiC and GaN MOSFETS, and diodes. To test and characterise such devices, you need faster measurement devices like higher bandwidth oscilloscopes and power analysers.

For design and architecture stages, key factors that help select test instruments include high-frequency dynamic behaviour, static behaviour, fast inverter switching, trigger for individual waveforms and overshoot on pulses. Measurement at this stage requires mixed-signal oscilloscopes with multiple channels.

Measured parameters

Dynamic behaviour of power electronics can be measured with a scopecorder (oscilloscope-cum-data acquisition recorder). A data acquisition recorder handles a wide range of power measurements and captures high-resolution details with a 12- or 16-bit ADC. A spacecorder carries out complex calculations to measure power factor, active power and harmonics using a digital signal processor.

Dynamic parameters such as switching times (Trise, Tfall, Tdelay or Trr) use high- bandwidth oscilloscopes. Static parameter measurements need curve tracers and parametric analysers. Static parameters include VCEon, VDS, RDSon, VF, VGE and leakage currents using curve tracers. Switching energies such as Eon, Eoff and Err are measured using high-bandwidth current probes and oscilloscopes with math functions.

Quality control measures

Power analysis, conversion efficiency and harmonics are measured for efficiency validation. A power analyser measures efficiency, total harmonic distortion and power factor correction of circuits. For these, the test power analyser should be of high accuracy and high stability. It should have calibration ability that can measure highly distorted current and voltage waveforms accurately.

Online inspection and troubleshooting are important to reduce costs and downtime, and improve the efficiency of various electronic components. For online inspection, thermal imagers are useful for PCBs and SMD cards, for fault diagnosis and research purposes. This is due to their high IR resolutions of 320×240 pixels and 640×480 pixels. These can also be used for the mass production of electronic components for monitoring, processing and quality control.

T&M equipment for power electronics

Nitin Shetty, chief executive officer, Convergent Technologies, says, “A galvanically-isolated solution like Tektronix TIVM Series IsoVu can resolve high-bandwidth differential signals up to 2500Vpk in the presence of large common-mode voltages. The latest T&M technology for power electronics is 8-channel, 12-bit ADC and deep memory MSO 5 series oscilloscope.

“MSO is available with eight high-resolution channels, easy-to-use user interface and a large HD touchscreen display along with advanced IsoVu probing solutions. It is suitable for designing an inverter, optimising a power supply and testing communication links. It measures across a current shunt resistor, debugging electromagnetic interference or electrostatic discharge issues, and eliminates ground loops in a test setup.”

A new way to test power electronics modules

A new method for characteristic measurement and reliability testing of thermally sensitive power electronics modules is more efficient and gets to the problem quicker.

With the focus on energy savings, there is a rapidly increasing emphasis on power electronics modules used in reusable energy applications, such as solar arrays and wind turbines, as well as the power grids that deliver electric energy throughout the world. They are used in electric and hybrid vehicles and their charger stations. Motor drive controllers and even consumer product chargers use them. With this much use, small improvements in their efficiency can save huge quantities of energy.

Meanwhile, several industry consortiums around the world are focusing on improvements to today’s power electronics modules and their applications. The companies in these consortiums are concerned not only with the efficiency of the power electronics modules, but also their reliability because many of the applications require modules that must last for years and decades without replacement.

The reliability challenge in power electronics

Many of the applications for power electronics modules require long life spans. For example, in wind turbines that may be located out in the oceans, it’s impractical to replace the modules. For solar arrays on satellites, it’s basically impossible to fix them. Electric vehicles and hybrids are expected to last 15 to 20 years without major repairs. So the challenge is to create modules at low cost and weight that will not only support the extremely high current requirements, but also last for many years. One method is to over-engineer, the modules but this approach adds to the cost and weight.

If they are designed to meet requirements without over-engineering, how can they then be tested for expected lifespan reliability without putting them in a test environment for years, even decades? The main issues that typically affect reliability are thermal stresses and overheating. We can approach this problem in steps. The first step is to design the modules so that they will work from a heat conduction point of view. The second step is to provide a method of testing the modules for their expected lifetime.

Reliability testing in power electronics

So now you have designed a module with good heat management, that is, it has significant heat flow paths from the junction to ambient. But you still don’t really know the expected lifespan. A method of accelerating the lifespan testing and understanding what exactly is going to eventually cause the modules to fail is needed.

The main issue with high power electronic modules is the thermal stresses imposed by the repeated heating and cooling as the module powers on and off during its normal operation. In today’s applications, these modules typically run from 100 to 1,500 amps with life expectancy of tens of thousands up to millions of power cycles. These thermal stresses and overheating can cause any number of failures. The various layers of the substrate can separate and, because air is a poorer heat conductor than the solid material, the well-designed heat path will fail and the die will overheat. The same thing can happen if the actual substrate material forms stress cracks. A power electronics module has multiple wire bonds connecting to the die to carry the heavy current loads. These wire bonds can eventually crack because of the thermal stresses or can detach because of solder failure.

Classic versus advanced reliability testing

The classic method of lifespan testing for a power electronics module requires multiple cycles through various stages in a laboratory. Typically, the IGBT module is hooked up to a power cycling source. The module may be cycled through a few hundred or a thousand cycles. Then the module is dismounted from the power cycler and taken to a lab for failure testing. If the module has not failed, the process of power cycling and failure testing is repeated. Once the module is determined to have completely failed, it is taken to a lab to determine the cause of failure. This process can involve X-ray scanning, visual inspection or even destructive dissecting of the module.

There are several issues with this classic method of reliability testing. First, it’s a long process. The repeated mounting, power cycling, dismounting and failure testing is time-consuming, especially if the number of cycles to failure is high. Second, the cycle count to failure start may be indeterminate. Only after the module has completely failed could it be determined to have failed in the lab. Also, if the diagnosis shows multiple failures, it is not always possible to determine the cause and effect; that is, which failure was the initial one that caused the other failure.

New technology for reliability testing

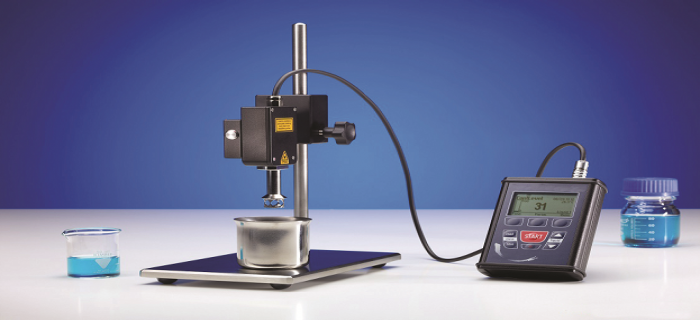

A more efficient process is needed that can determine the exact cause of the failure quickly. Such a solution needs to be able to measure electrical and thermal effects in the module during the power cycling and recognize the failure cause in real-time, without having to rely on a post-mortem diagnosis. If the power cycling and measurement is contained in the same hardware, there is no need to dismount the modules from the power cycler and take them into the laboratory for failure analysis. Recent developments in the industry, such as the MicReD Industrial Power Tester 1500A from Mentor Graphics, are providing this capability.

The key to efficiency is to combine the power cycling with on-line, real-time diagnostic testing and to be able to analyze multiple characteristics of the module under test simultaneously. An example uses a maximum of 1,500 amp power cycling that can either be applied to a single module or as many as three separate modules. It has measurement capability that senses the module’s structure, voltages, junction temperature, and other characteristics in real time. The touch-screen controls make it easy to set up and run, making it appropriate for both laboratory and production environment usage.

Using the real-time structure function

The structure function produced by the T3Ster provides the ability to “look” inside of the module and measure the thermal characteristics of the module’s substrate layers. This same technology can be used during the power cycling to sense substrate layer delamination and cracking.

Figure 4 shows a structure function graph with snapshots taken at this particular module’s 0; 5,000; 10,000; 15,000; 20,000 and 25,000th cycles. The blue and green lines are coincident and basically show the original “good” module’s layer characteristics. But at the 20,000th cycle, we see that the lines start to go more horizontal, indicating an increase in the resistance of the base plate solder layer. This continues to happen through the 25,000th cycle. The increase in resistance indicates a delamination of the layer, an interruption of the heat path from the die to ambient, and will probably result in overheating of the die and eventual failure.

With the classic method of testing, a failure may not have been recognized at this point. Later in the classic process, after complete module failure, multiple layers may have delaminated because of the excessive heat, but failure of the initial layer would not have been seen.

Other causes of failure diagnosed

The structure function can be used effectively to sense such failures as substrate layer delamination and cracking. But other failures can occur in the modules, such as wire bond cracking or solder failure. For these types of diagnostics, the power tester has to include very sensitive methods of measuring changes in voltages and currents. For a module that contains multiple wire bonds per die, the ability to see when a single bond has failed is needed. This can be achieved by measuring small increases in the forward voltage being applied during powering up of the module. If a bond fails, the resistance to the die will increase slightly, thus increasing the forward voltage slightly.

Market opportunities

India has the potential to be among the forerunners in the next phase of technology innovations. The Indian electronic systems design and manufacturing (ESDM) sector has witnessed steady growth in recent years, with the focus shifting from pure play system or product design to include other areas such as product development, original design manufacturing (ODM), etc. Therefore, immense business opportunities are brewing in the Indian T&M industry.

Conclusion

With respect to the user experience, touchscreen technologies are going to revolutionise the T&M environment. A combination of the right hardware with a ‘designed for touch’ user interface (UI) will enable companies to use equipment easily and efficiently. ‘Designed for touch’ UIs are crucial for creating an effective and usable touchscreen, since it is not enough to simply add a touchscreen to an existing UI. The new age T&M equipment needs to identify, isolate and analyse a system under test as quickly and efficiently as possible. Having an effective touchscreen on the instrument can reduce the time it takes to configure the system and to analyse signals. Thus, instruments with better GUIs result in ease of operation and automated testing capabilities, which increases productivity.

(1).gif)

leave your comment